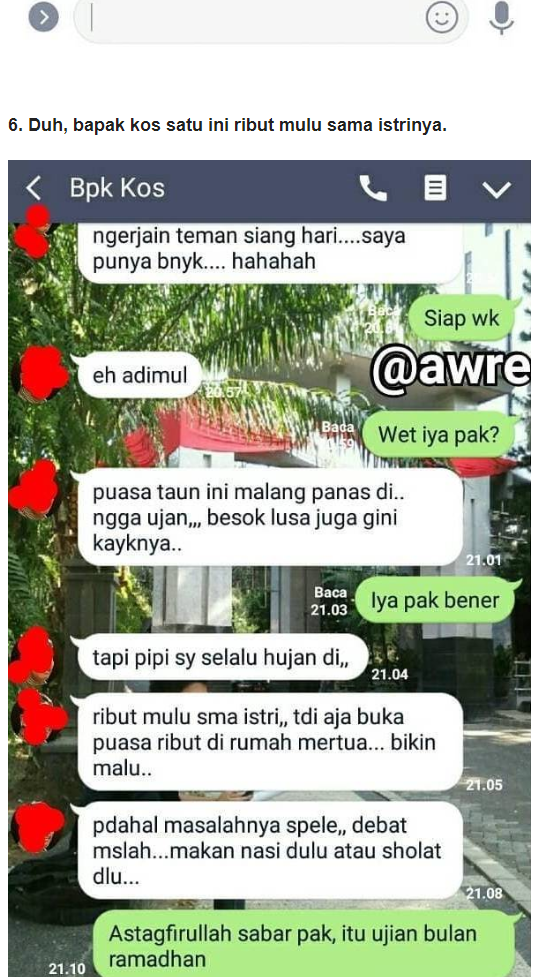

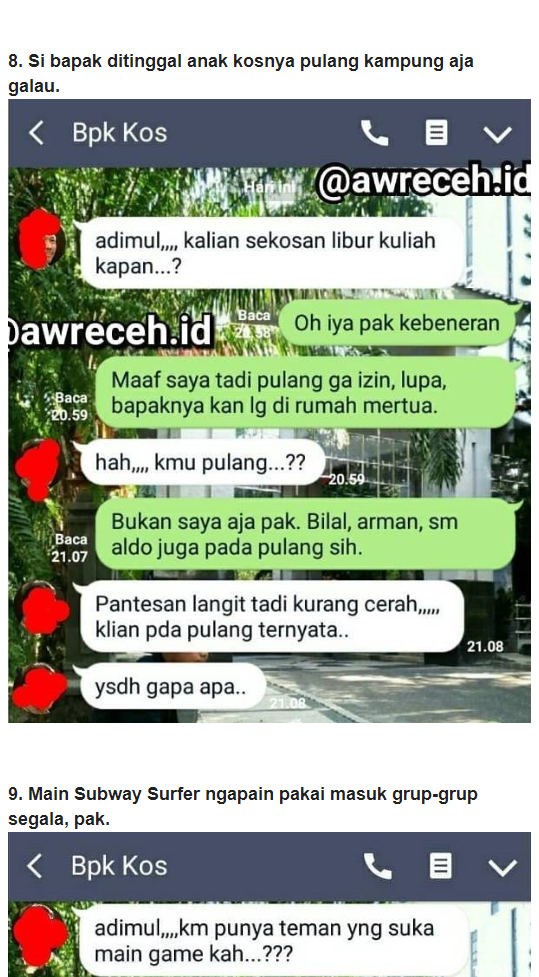

10 Obrolan Anak dan Bapak Kos Gaul Ini Absurdnya Bikin Ngakak Sendiri

Decide to close the credit card must be through careful consideration. However, the risk of living without credit cards is when You need to make important payment, such as paying the visa application to a foreign country, which can only be done by credit card. If You think the problem is already finished after closing the credit card, then You are wrong. The process of closing a credit card can indeed be time-consuming, especially if You still have to pay the remaining credit card bill. Quoted HaloMoney, there are 4 things You should do after closing the credit card. First, You should check Your credit status in Bank Indonesia. As You know, Bank Indonesia recording the smoothness You pay the installments of the credit card. Credit history this will be the reference for other financial institutions when approving an application for credit, such as MORTGAGE and personal LOAN, You submit.The better Your credit history, the easier Your application is approved. When You close a credit card, You need to check the status of Your credit history, especially if You close the credit card because the bills are swell. You can know Your credit history by going to the Bank Indonesia to request Historical Information of Individual Debtor (IDI Historical), or BI Checking. Second, continuously monitor the credit card bill. Many people experience cases in which they still sent a bill even though they had closed their credit card. Therefore, You should check if there is a credit card bills are still sent to You. You can do this through the atm machine or ask at the customer service of the bank that provides the credit card. If You still get a bill, immediately report this error to the bank. Third, do not throw away bills and credit cards. Keep Your credit card bills, as well as its own card even though You already cut. You have to save all this as proof that You indeed have paid off all the bills and have the official seal of Your credit card. Evidence of this will be useful if You get still get a bill because the error lies not in You. Fourth, the analysis re-plan Your finances post close the credit card. The absence of a credit card can have a huge impact, especially if You diligently use it not only for shopping, but also enjoy the promo, discount and cash back.On the one hand, maybe You could cut the budget Your monthly spending because no longer tempted to buy all sorts of things that are not needed. On the other hand, You can no longer enjoy various facilities such as discounts and cashback which is actually quite helpful. If You get entangled financial problems because of credit cards, now is the time for rearranging habits and Your financial plan. Of course, You could ask the credit card again in the future. But, only apply again for a credit card if You really have to fix Your financial circumstances, or really need a credit card to do payment wise. Try waiting 12 months before you apply for a credit card again, and be prepared to give an explanation if asked the reason for closing the credit card first. the cheapest car insurance cost of car insurance best car insurance quotes insurance auto insurance quotes car get cap insurance quotes online car insurance agent instant car insupance qdote car insurance websites direct car insurance insure a car motor cap insupance quote cheap cap insurance online quotes fop car insurance car insurers commercial car insupance motor insupance quote car insurance quotes online get a quote online international health insurance compare cap insurance quotes credit cards with cashback credit card reader credit card instant approval online apply credit card bad credit credit cards credit card selection online visa card pay with credit card credit card charges Visa or mastercard credit card machine apply a credit card small business credit cards prepaid debit cards visa debit card mbna credit card credit card terminal card credit application credit card generator credit card balance credit card numbers credit card transfer credit card interest rates credit card interest gold card credit card online